For entrepreneurs andsmall business owners, securingthenecessaryfundsto start, expand, ormanagetheir businesses canoftenbe a dauntingtask. Thisiswhere Chase For Business come into play.

As a leading financial institution, Chase offers a range of business loanoptionsdesignedtosupportthegrowthandsuccessof businesses ofallsizes. In thisarticle, we’ll take a closer look at Chase For Business, theirvariousofferings, andhowtheycan help entrepreneurs achievetheirgoals.

Typesof Chase Business Loans

Chase offers a varietyof business loanproductstomeetthediverseneedsof entrepreneurs and business owners. Here are some ofthemost popular options:

Chase For Business

No hidden fees Products for every sizeBusiness TermLoans: Chase Business TermLoansprovide a lump sum of capital thatcanbeused for various business purposes, such as purchasingequipment, expandingoperations, orrefinancingexistingdebt. Theseloanstypicallyhavefixedinterest rates andpredictablemonthlypayments, making them a popular choice for long-terminvestments.

Business LineofCredit: A Chase Business LineofCreditis a flexiblefinancingoptionthatallows business ownerstoaccessfunds as needed, upto a predeterminedcreditlimit. Thisrevolvingcreditlinecanbeused for short-termworking capital needs, coveringexpensesduringslowperiods, ortakingadvantageofopportunities for growth.

Learn more

SBA Loans: Chase isalsoanapprovedlender for Small Business Administration (SBA) loans, including SBA 7(a) and SBA 504 loans. Thesegovernment-backedloansprovide businesses withcompetitiveinterest rates andextendedrepaymentterms, making themanattractiveoption for startups andestablished businesses alike.

Commercial Real EstateLoans: For businesses lookingtopurchase, refinance, orrenovatecommercial real estateproperties, Chase offersCommercial Real EstateLoans. Theseloanscan help business ownersacquirethespacetheyneedtooperateandexpandtheiroperations.

EquipmentFinancing: Chase providesEquipmentFinancingsolutionsthatenable businesses toacquireessentialequipmentandmachinerywithouttyinguptheirworking capital. Thisfinancingoptionoffersfixed rates andtermstailoredtothelifespanoftheequipment.

Benefitsof Chase For Business Loans

- Competitive Rates: Chase offerscompetitiveinterest rates on its business loans, helping businesses savemoneyonfinancingcosts.

- FlexibleTerms: Chase Business Loans come withflexibletermsandrepaymentoptions, allowing businesses tochoose a planthatalignswiththeir cash flowand financial goals.

- Quick andConvenientApplicationProcess: Chase’sstreamlinedapplicationprocessandexperiencedloanadvisors make it easier for businesses toapply for andsecurethefinancingtheyneed.

- Access to Expertise: Chase providesaccessto a teamofexperiencedbankersand financial professionalswhocanoffervaluable insights andguidanceto help businesses make informedfinancingdecisions.

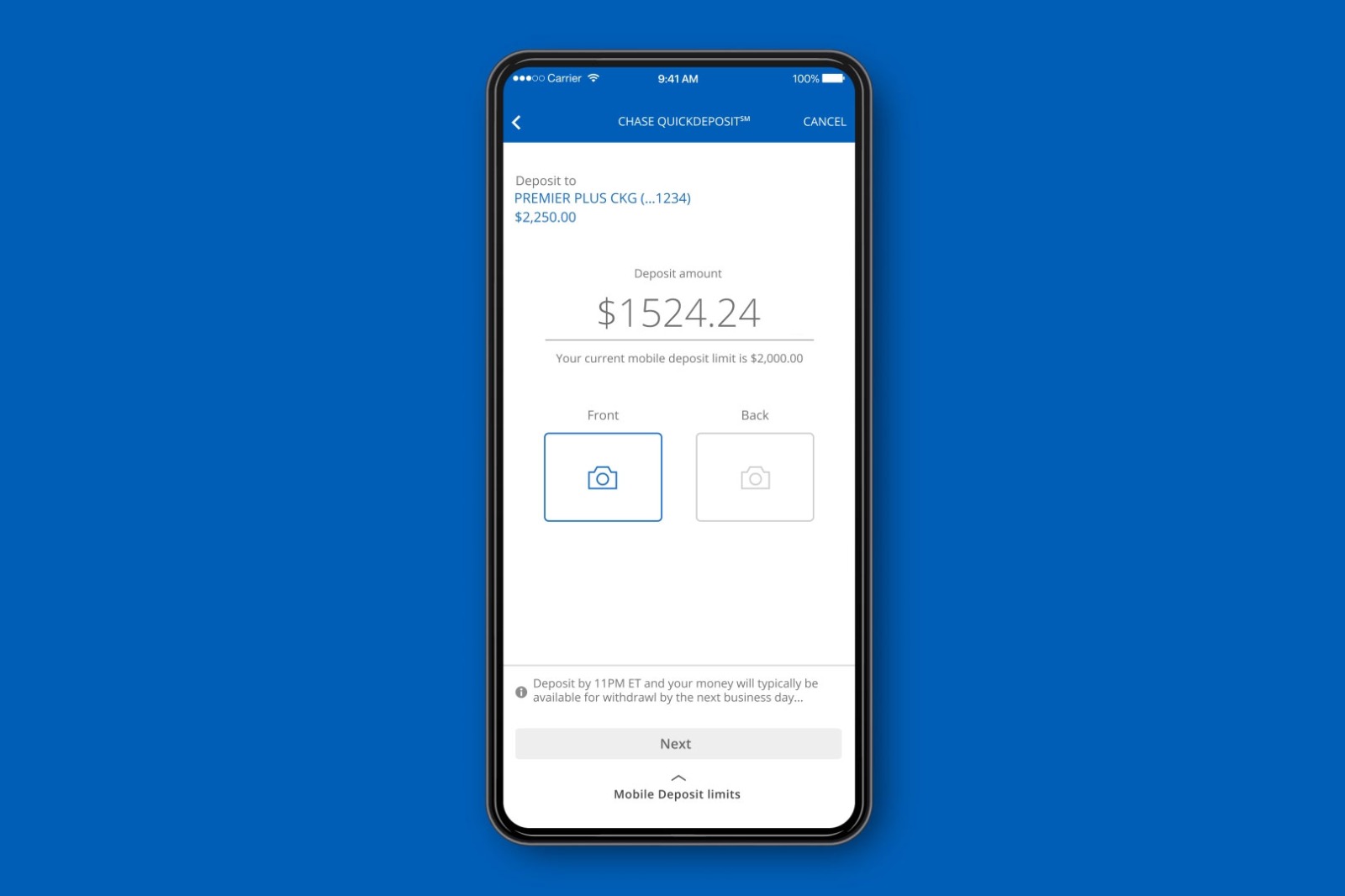

- Online Banking Tools: Chase offersrobust online banking tools andresourcesto help businesses managetheirloansand track their financial healthwithease.

EligibilityandApplicationProcess

Toapply for a Chase Business Loan, businesses typicallyneedtomeetcertaineligibilitycriteria, such as demonstrating a strongcredithistory, providing financial statements, andhaving a solid business plan. The applicationprocessmayvarydependingonthetypeofloan, butChase’sdedicatedloanadvisors are availabletoassistateverystep.

Chase For Business play a crucial role in supportingthedreamsandaspirationsof entrepreneurs and business owners. With a wide range offinancingoptions, competitive rates, andflexibleterms, Chase offers a helpinghandto businesses ofallsizesandstages.

Whetheryou’relookingto start a new venture, expandanexistingone, orsimplymanageyourday-to-dayoperations more effectively, Chase For Business canprovidethe financial solutionsyouneedtosucceed. So, ifyou’rereadyto take your business tothenextlevel, considerthesupportand expertise that Chase hastooffer.

BankAmericard® Credit Card for Students — Your First Step Toward Responsible Credit Building

BankAmericard® Credit Card for Students — Your First Step Toward Responsible Credit Building  Take Control of Your Finances with the U.S. Bank Split™ World Mastercard®

Take Control of Your Finances with the U.S. Bank Split™ World Mastercard®  Spend Smarter Every Day with the U.S. Bank Smartly™ Visa Signature® Card

Spend Smarter Every Day with the U.S. Bank Smartly™ Visa Signature® Card